Uncovering the faces behind our circuits: the global production of semiconductors

Author: Matilde Castleberry

If semiconductors have the power to connect the entire globe, those who produce them have the power to decide whether, and at what speed, to do so. But who truly wields this authority? Let's discover it together.

In our previous article, we discussed: semiconductors, connecting or dividing the world? The semiconductor value chain displays significant dispersion, with only a handful of companies or organisations positioned to oversee the entire end-to-end value chain. These exceptional entities are known as Integrated Device Manufacturers (IDMs). However, we can categorise the remaining companies into two prominent models based on their roles within the production cycle.

The first group is commonly known as "fabless." These companies design and market the products while outsourcing their fabrication to a "foundry." Foundries specialise exclusively in engineering and manufacturing, operating semiconductor fabrication plants. This division lowers production costs because foundries are often located in areas with abundant and cost-effective skilled labour. So how can we categorise the top semiconductor companies?

The top 5 semiconductor companies. Fabless, foundries or IDMs?

Top 5 companies by Trailing Twelve Months Revenue (TTM) as of June 2023, are:

1. Samsung TTM (2023): € 190B

2. Taiwan Semiconductor Manufacturing Co. Ltd. (TSMC) TTM (2023): € 70B

3. Intel Corp. (INTC) TTM (2023): € 50B

4. Qualcomm Inc. TTM (2023): € 35B

5. Broadcom Inc. TTM (2023): € 32B

Among these, INTC and Samsung are IDMs with the latter heavily investing in its fabrication plants as stated in its Foundry forum 2023. TSMC is the lone Foundry, and the last two are Fabless. The collaboration between Fabless and Foundries has proven successful, resulting in a revenue size increase of over 15 times in the merchant foundry market since 1998.

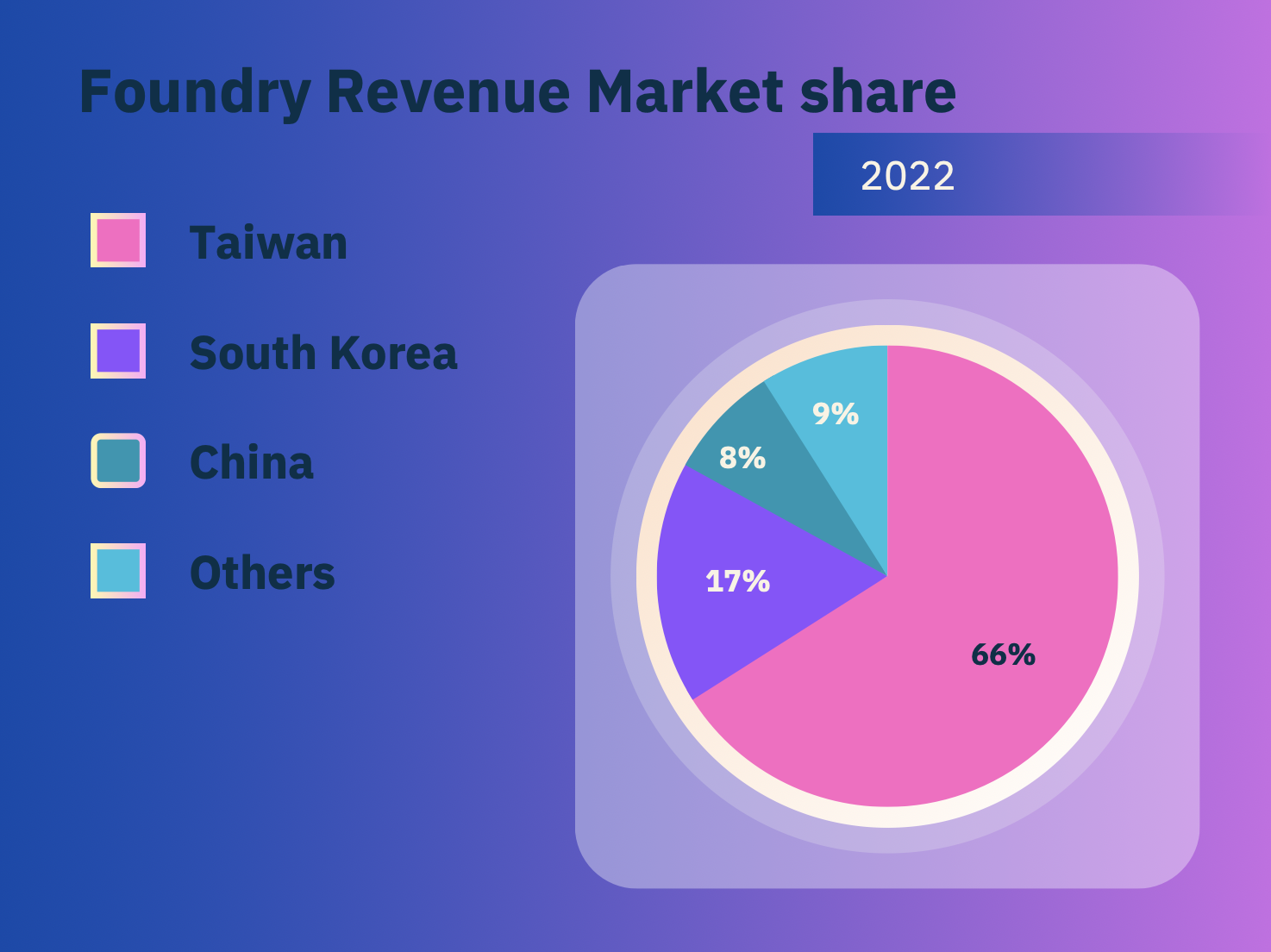

If instead, we were to list the leading countries in chips manufacturing, the dominance of the Asian region would be even more clear. The Foundry Revenue Market share of 2022 according to TrendForce, was 66% for Taiwan, 17% for South Korea, 8% for China and 9% for others. Considering that most manufacturing comes from one region, leaving to it the strongest hold on semiconductors, then why haven’t regions like the US or Europe invested in fabs in the past years in order to secure semiconductor supply?

The Hardships of establishing fabs and Restructuring GVCs

Despite it sounding like the most logical thing to do, many fabless don’t transition into IDMs and here are the three main reasons why:

The first reason is economic in nature. We have shifted from constructing semiconductor fabrication facilities for less than €475 million in the mid-1990s, to now unveiling plans for massive fabs with estimated price tags ranging from €11 billion to €14 billion. Nowadays, only a select few semiconductor firms possess the financial resources required for such ambitious fab projects. In fact, the top three companies in this industry collectively allocate half of the overall capital expenditure across the entire sector.

The second reason is practical: a shortage of skilled labour. Recently, a team of experts discussed the reasons why this sector represents a promising path for young talents. However, to bridge this gap it is essential to invest in Research and Development (R&D), which is typically costly and falls within the purview of States.

- If you're interested in news and events related to the semiconductor industry, you can find them on our website! -

The third reason, on the other hand, has a legal origin and pertains to Intellectual Property (IP) obstructing innovation. Stringent intellectual property (IP) regulations can limit the capacity of new players to cultivate revolutionary semiconductor technologies by discouraging potential competitors from entering the market due to the threat of IP infringement lawsuits (The Way Forward for Intellectual Property Internationally). Patent and copyright regulations now need to adhere to fundamental international standards, thus eliminating the possibility of industrial replication, which played a pivotal role in the industrial strategies of South Korea and Taiwan during the 1960s and 1970s.

On this journey through the intricate world of semiconductor production we have uncovered the global giants and witnessed the struggles of emerging foundries. Our next destination is the European Union, where a new era of microelectronics is unfolding. Join us as we explore the EU’s current production and its determined efforts to secure its place in the semiconductor industry. Stay tuned!